BNEF Release| Ranking of new installed capacity of global wind turbine manufacturers in 2023

2024.03.27

Bloomberg New Energy Finance

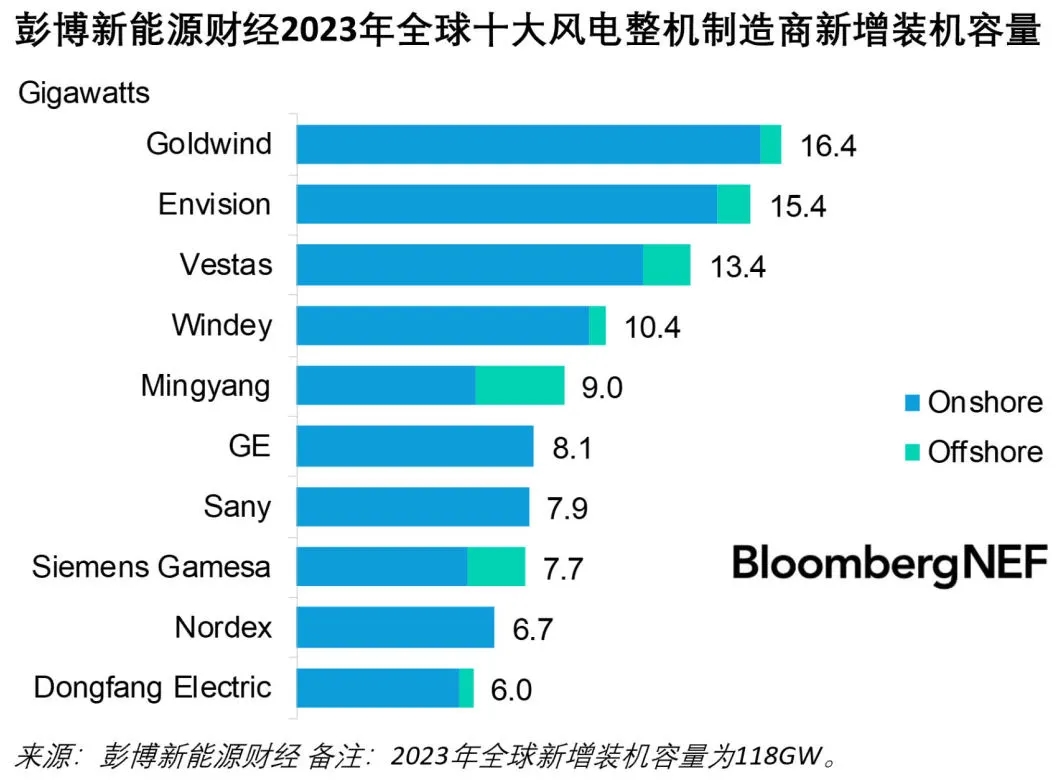

According to data recently released by Bloomberg New Energy Finance, the new installed capacity of global wind power in 2023 will be 118GW, an increase of 36% compared with 2022. Among them, the installed capacity of onshore wind power was 107GW, an increase of 37% year-on-year; The installed capacity of offshore wind power was 11GW, an increase of 25% year-on-year. The growth of global wind power installations in 2023 is mainly due to the strong installation of 77GW in the Chinese market.

Thanks to the rapid development of China's wind power market, Chinese companies have four of the top five new capacity of global wind turbine manufacturers. Goldwind retains the top spot with 16.4GW of new installed capacity, 95% of which is located in China. Envision Energy added 15.4GW of new installed capacity, ranking second. Danish machine manufacturer Vestas ranked third with 13.4GW of new installed capacity, making it the only European machine manufacturer to make it into the top five. Yunda Co., Ltd. and Mingyang Intelligent ranked fourth and fifth respectively.

Ninety-eight percent of China's new installations in 2023 will come from the domestic market, but they are expanding further into overseas markets. In 2023, Chinese OEMs added 1.7GW of new capacity overseas, with projects spread across 20 markets around the world, including five EU member states, and nearly triple the number of overseas installations by Chinese OEMs last year compared to 2018. Thanks to the rapid cost reduction, the low price has created an opportunity for the export of wind turbines in China. According to the Bloomberg New Energy Wind Turbine Price Index report, the prices at which wind turbines sold overseas in China are on average 20% lower than those of their Western competitors. Goldwind will add the most new overseas capacity in 2023, reaching 748MW. Envision Energy ranked second with 561MW of new installed capacity in overseas markets.

U.S. machine manufacturer General Electric (GE) ranked sixth, down three places from its 2022 ranking. While GE still has the highest market share in the U.S., its new capacity additions in the U.S. fell 35% year-over-year as new capacity additions in the U.S. fell to the lowest level since 2017 in 2023.

The global wind power market outside of China will only add 8% of new capacity in 2023 year-on-year, but market growth is about to accelerate. Thanks to the implementation of the U.S. Inflation Reduction Act, U.S. wind turbine orders have increased recently. At the same time, the number of approved wind power projects in countries such as Germany is increasing under the influence of the European wind power project approval reform.

In the offshore wind power market, Chinese machine manufacturer Mingyang Intelligent will add nearly 3GW of offshore wind power capacity in 2023, doubling year-on-year, becoming the world's largest offshore wind turbine supplier for the first time in 2023. Siemens Gamesa failed to regain its position as the offshore wind leader for the third year in a row last year since it topped offshore wind power in 2017.

Related testimonials

CCTV Finance × Sany Heavy Industry: Transportation construction continues to heat up! In May, the infrastructure was full of bright spots →

2025.06.17

CCTV Finance × Sany Heavy Industry: Infrastructure results are released! Anhui is soaring, and the equipment of the western port has become a "dark horse"

2025.05.19

China's installed wind and solar capacity has historically surpassed that of thermal power

2025.04.28

0 comments