After the European Union, Canada plans to launch a "carbon border adjustment mechanism", or impose a carbon tax on Chinese goods

2021.08.27

On August 5, Canada's Ministry of Finance launched an exploratory consultation on the Border Carbon Adjustments for Canada (BCA) and solicited comments from citizens. This means that since the EU launched the Carbon Border Adjustment Mechanism (CBMA), another major Chinese trading partner has launched a "carbon tax" mechanism. The regime could impose a hefty carbon tax on exports from China that are produced using coal-fired power generation without a clear "green energy" label.

Tackling climate change is a global imperative, and Canada is doing its part to meet climate ambition and increase the price of carbon to meet climate goals, the report quotes. As Canada and other countries work to meet their international climate commitments, there will inevitably be differences between countries in terms of implementation methods and speeds. A key emerging challenge is how to address these differences in a coordinated manner to achieve lower outcomes in greenhouse gas emissions, while reducing pressure on international trade without inadvertently undermining Canada's global competitiveness. Helping to achieve this requires the establishment of a Carbon Border Adjustment Mechanism (BCA).

Under the Paris Agreement, countries are required to submit more ambitious climate targets (known as NDCs, Nationally Determined Contributions) every five years. In response to the scientific evidence that more ambitious climate action is needed (Refer to the IPCC reportThis year, all countries are being asked to increase their carbon reduction targets through updated Nationally Determined Contributions. On April 22, 2021, Canadian Prime Minister Justin Trudeau announced an updated target of a 40-45% reduction by 2030 compared to 2005 levels, and on July 12, 2021, this new NDC was formally submitted to the United Nations. To support the achievement of Canada's 2030 climate goals and put the country on a path to net-zero emissions by 2050, the Government of Canada released an enhanced climate plan, A Healthy Environment and a Healthy Economy, in December 2020.

This enhanced climate change plan is a follow-up to the 2016 Pan-Canadian Clean Growth and Climate Change Framework and is Canada's first-ever national plan to reduce greenhouse gas emissions. Canada's federal government, along with provinces and territories, has developed a program to support clean technology that helps adapt to a changing climate. The plan uses carbon pollution pricing as a foundational pillar, deciding to reach a carbon price of $50/ton by 2022. and determine that carbon pricing continues to play a central role in Canada's enhanced climate change plan.In July 2021, the government confirmed that Canada's carbon price will continue to increase by $15 per year beyond 2022 until it reaches $170/t by 2030.In addition to the $15 billion investment announced in Canada's Climate Enhancement Plan, the 2021 budget commits $17.6 billion for a green recovery to create jobs, build a clean economy, and combat climate change. This includes government support for household energy retrofits, new tax measures to accelerate carbon capture, utilization, and storage, and significant commitments to decarbonize investments in large emitters.

As Canada and other countries work to meet their international climate commitments, there will inevitably be differences between countries in terms of implementation methods and speeds.Canada believed that countries could act in different ways and that what needed to be considered was how to combine those approaches. The Government of Canada is committed to ensuring Canada's transition to a low-carbon economy in a way that is fair and predictable to domestic companies and consumers, and to supporting Canada's international competitiveness. In the fall of 2020, the Government of Canada announced its intention to explore the potential of the Border Carbon Adjustment (BCA) Mechanism as part of Canada's transition to a low-carbon economy. The government first stated in its economic statement in the fall of 2020 and most recently in its 2021 budget that it would work with like-minded countries to consider how this approach could be incorporated into a broader strategy consistent with achieving climate goals in a way that remains competitive in Canada in a fair and open trading system. The 2021 budget also announced the government's intention to consult on the BCA.

The new consultation paper says this is not an issue that Canada can solve alone. Discussions with countries that have set climate ambitions, especially with major trading partners, are also important, as these partners face the same challenges.This year, the EU has already taken an important step forward in terms of carbon border taxes by adopting a legislative proposal on the Carbon Border Adjustment Mechanism (CBMA). In addition, the Prime Minister of Canada and the President of the United States agreed in February 2021 to an updated roadmap for the U.S.-Canada partnership, in which the two countries pledged to work together to address the impact of climate policy disparities on global trade.

The government has released the CBA Consultation Report in the hope of hearing from Canadians and working with international partners to address the challenge of climate change and reach a common understanding of what BCA is and how it operates. The report introduces the different types of BCA, what they aim to achieve, and considers BCA from three main perspectives:

Environmental outcomes- Add BCAs to Canada's climate policy toolbox on how to achieve equal or better environmental outcomes from Canada's existing climate change policies. Economic pressures- The likely economic impact of BCA, and the distribution of these impacts across sectors and regions, including the impact on consumers. International Engagement and Trade Relations– How the BCA may affect Canada's trade relationship as a trade-dependent economy, and areas where further work is needed with trading partners on the BCA.

The report builds on the above reflectionsAnother step forward is how to coordinate concrete approaches with international partners on climate change policy and ensure shared prosperity。

According to the report,The carbon border tax BCA can typically take the following forms:

·Yes fromImport charges levied on goods from countries that do not have a carbon price or adopt a lower carbon priceto ensure that they face carbon costs similar to those applicable to domestic producers (e.g. emissions per unit of production of goods)

Other measures that could apply a carbon price to imported goods, including imposing domestic taxes or fees on imports from high-carbon countries, or requiring the purchase of carbon emission allowances based on the carbon intensity of imported goods.

·OKExport tax rebates are provided to producersso that domestically produced goods compete on an equal footing in foreign markets with goods from countries with limited or no carbon pricing.

Under Canada's current carbon pricing system, the risk of carbon leakage can be mitigated by designing some domestic pricing systems.The most at-risk sectors, i.e., emissions-intensive and trade-exposed industries (EIEs)), are subject to carbon pricing, but typically do not face full emissions pricing.In addition, the government provides financial support for investments in emission reduction technologies, thereby improving the environmental performance of the EITE sector, and broader support for industrial innovation to help improve competitiveness. As countries, including Canada, step up their fight against climate change, they need to consider the best mix of policies and tools to achieve greenhouse gas emissions reductions while mitigating the risk of carbon leakage. BCAs can provide a useful tool that can be used as an add-on or alternative to existing methods of mitigating carbon leakage.

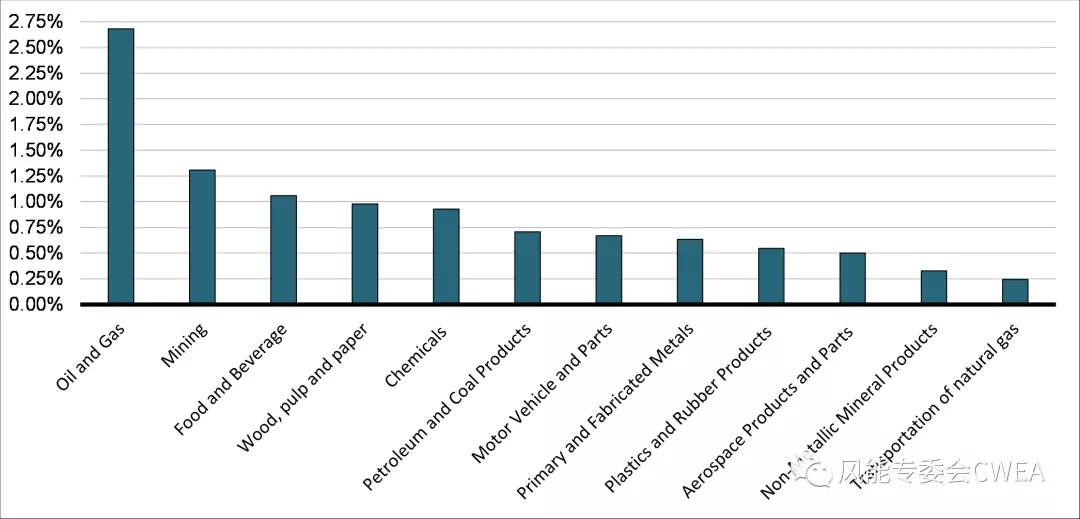

The contribution of production in EITE sectors and industries to the Canadian economy ranges from 9.2% to 10.6%, as measured by their gross value added as a percentage of total GDP. The chart above shows the contribution of each EITE sector to GDP.

As the Canadian government explores the role of BCA, important considerations fall into three main categories: environmental, economic, and international trade.

For example, in terms of environmental considerationsCan BCA enable domestic climate policies to support Canada's carbon reductions (including incentives for technological innovation) better than existing carbon leak mitigation measures? Will the possible costs of BCA create a new risk of carbon leakage for downstream industries? Can BCA Canada incentivize other jurisdictions to adopt more ambitious climate policies and contribute to global efforts to reduce greenhouse gas emissions?

In terms of economic considerations,Is BCA more effective than existing carbon leak mitigation measures to improve the competitiveness of Canadian producers? Does BCA create competitive pressure issues for downstream industries? What is the impact on Canadian consumers?

In particular, international trade considerations, as a measure affecting traded products, the BCA will be subject to Canada's international trade law obligations (e.g., under World Trade Organization agreements and Canada's free trade agreements). As a trade-dependent economy, Canada must consider how the BCA will affect trade relations and the multilateral trading system more broadly. Canada must move forward in partnership with its key trading partners, as well as those that have taken action on climate ambition, to ensure that free and open trade among climate-ambitious partners continues to benefit. For example, there are questions that arise when it comes to Canada's international engagement with trading partners, such as: Is there an opportunity for Canada to form alliances with other countries exploring BCA? What are the risks to Canada's trade relationship with the adoption of BCAs? How is the BCA designed to comply with Canada's international trade law obligations? Should the BCA provide exemptions (or other flexibilities) for imports from certain developing countries or countries that are also taking ambitious steps to reduce greenhouse gas emissions?

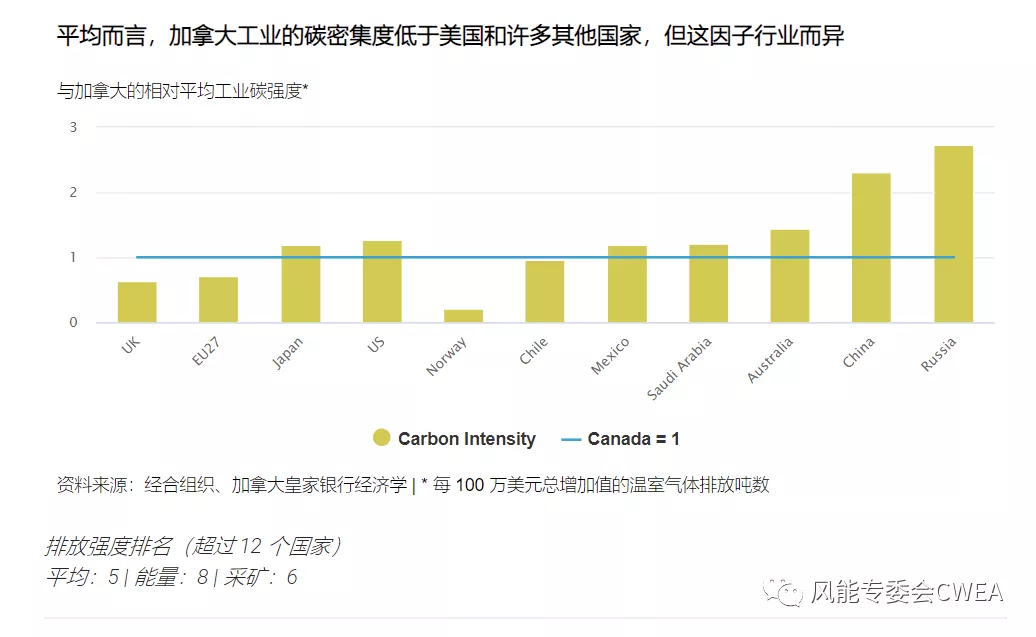

On the issue of carbon taxes, a report from the Royal Bank of Canada (RBC) statesThe idea of taxing carbon-intensive imports, while gaining global acceptance, could hurt Canada's export-intensive industries. As in the consultation above, the Emissions Intensive and Trade Exposed Industries (EIEs) are the sectors most at risk of being subject to carbon pricing, but are generally not subject to full emissions pricing. As a result, the report notes that Canada will not be hit hard by the European Union's recent proposal for the world's first carbon border pricing scheme. But given Canada's moderate performance in emissions, a broader implementation of the CBM could pose a significant challenge to Canada's highly trade-exposed economy. Moreover, while Canada's domestic carbon pricing system should help insulate it from new carbon-based trade rules, efforts by countries to use border carbon taxes to punish climate laggards and geopolitical rivals could come at a cost. The report recommends that Canada promote international cooperation on border carbon taxes to protect domestic industries while advancing international progress on climate goals.

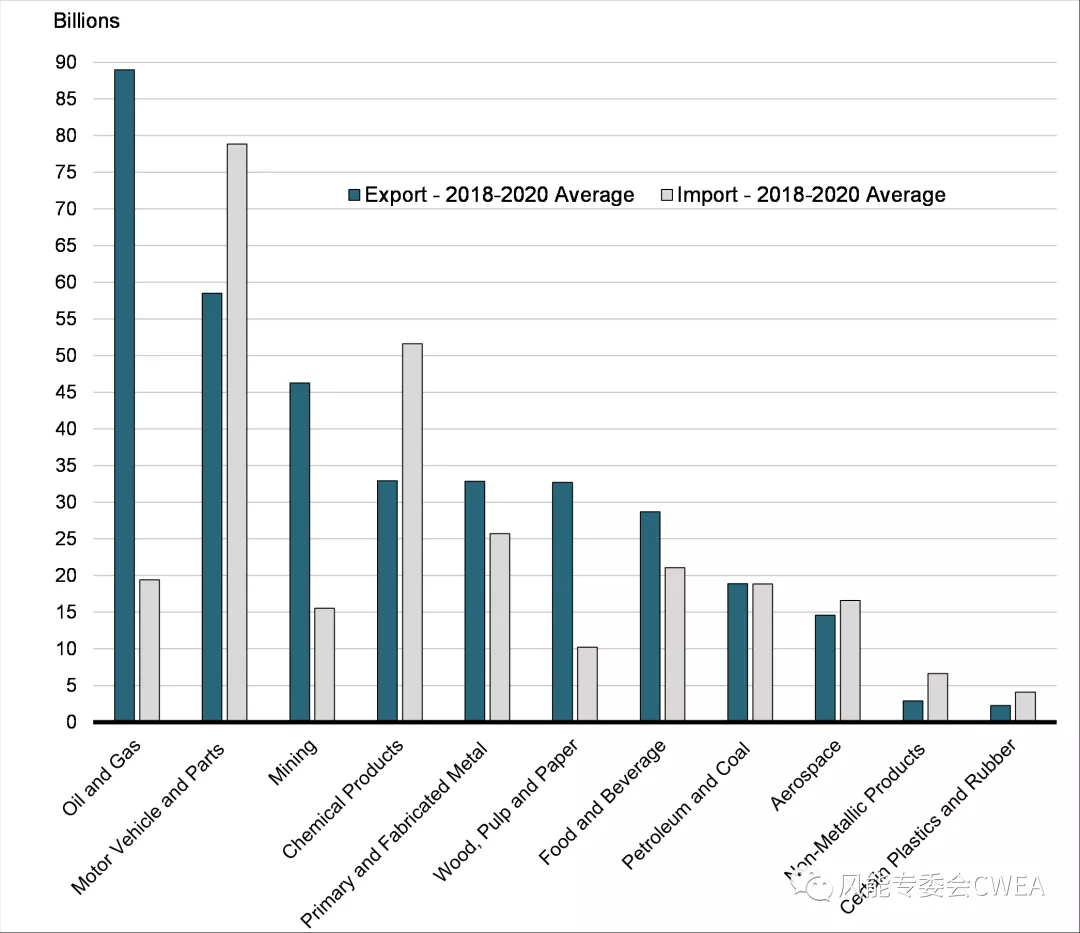

The RBC report argues that Canada's share of industrial exports to the EU is relatively small (about 5% of total exports of industrial goods), suggesting that it will not face significant challenges from the EU's proposed policies. Energy extraction and mining – two key industries in Canada – were not even initially targeted by the EU's current plans.

But the threat of a broader border carbon adjustment tax – particularly from the US – could have a significant direct macro impact on Canada's highly trade-exposed industrial sector.More than half of the economic value created by Canada's eight major industries is exported.

RBC's report argues that the Canadian federal government should push for G7 cooperation, given the risk that some countries could use the border carbon adjustment mechanism, putting Canadian industry at a disadvantage and exacerbating trade tensions. It could also capitalize on the current U.S. administration's desire to work with allies on key trade issues to actively work together to develop a carbon regulation mechanism at the North American border.

As a country that already puts a price on domestic carbon, it is in the country's interest to ensure a level playing field for domestic industry. Border carbon regulation can do this, while contributing to broader progress towards net zero through higher domestic industrial emissions pricing. While a higher carbon price may challenge Canada's domestic industry in the short term, the investment and innovation needed to support long-term industrial competitiveness in the green economy.

Related testimonials

CCTV Finance × Sany Heavy Industry: Transportation construction continues to heat up! In May, the infrastructure was full of bright spots →

2025.06.17

CCTV Finance × Sany Heavy Industry: Infrastructure results are released! Anhui is soaring, and the equipment of the western port has become a "dark horse"

2025.05.19

China's installed wind and solar capacity has historically surpassed that of thermal power

2025.04.28

0 comments