Sany Heavy Industry Sany Heavy Industry Co., Ltd. (SH:600031)

Trinity International Sany International (HK:00631)

Sany Renewable Energy Sany Renewable Energy (SH:688349)

Home > Industry information > The central government issued a document! The carbon reduction project of oil companies welcomes major benefits!

The central government issued a document! The carbon reduction project of oil companies welcomes major benefits!

2021.09.16

Carbonhopper Lab

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council issued the "Opinions on Deepening the Reform of the Ecological Protection Compensation System", and issued a notice, requiring all regions and departments to conscientiously implement it in light of actual conditions.

The opinions emphasize that under the premise of reasonable and scientific control of the total amount, the construction of a national energy use rights and carbon emission trading market should be accelerated, and the carbon reduction projects launched by oil companies will welcome major benefits.

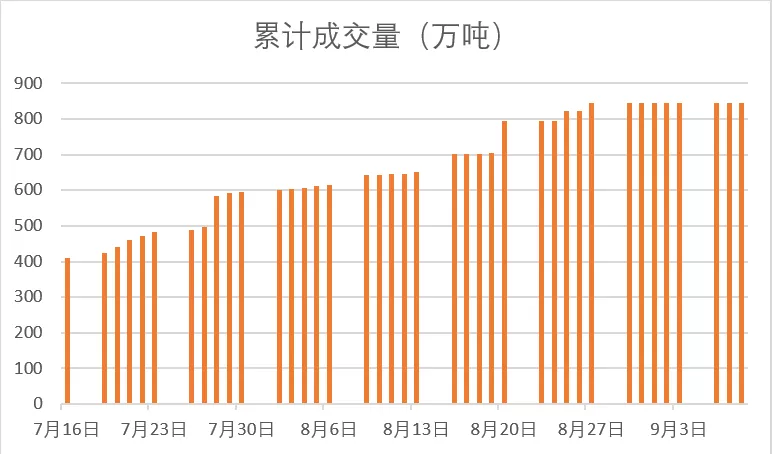

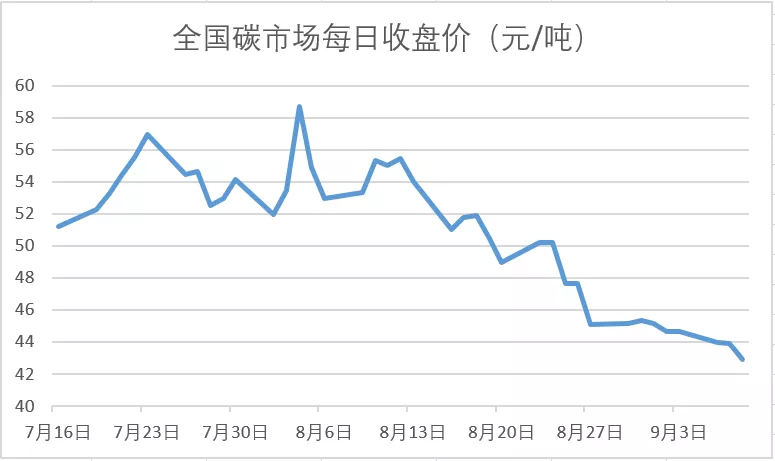

Since the opening of the national carbon emission trading market (hereinafter referred to as the carbon market) on July 16 this year, the cumulative trading volume of carbon emission allowances has been 8.44 million tons, with a cumulative turnover of more than 400 million yuan, and the carbon price has fluctuated between 40~60 yuan/ton.

Source: Shanghai Environment and Energy Exchange

After mid-to-late August, the heat brought by the opening of the market gradually faded, and the activity of China's carbon market has decreased, with the carbon price falling from more than 50 yuan/ton to more than 40 yuan/ton, and the single-day trading volume has also dropped sharply.

Source: Shanghai Environment and Energy Exchange

As the vane of the carbon market, carbon price provides an important reference for emission control enterprises to make emission reduction decisions, and also releases price signals to the energy market

What will be the adverse impact of a low-carbon price?

At the enterprise level: low-carbon prices will reduce the enthusiasm of enterprises to reduce emissions. Low-carbon prices mean that the cost of carbon emissions is reduced, and when high-emitting companies can purchase carbon allowances at a lower cost, their incentive to invest in emission reduction costs will decrease.

Market level: low-carbon prices are not conducive to the healthy development of the new energy industry. If the carbon price remains low for a long time, it will be difficult to reflect the low-emission cost advantage of clean energy.

In contrast, the carbon price of the EU carbon market is in the opposite direction of the domestic market, and it has continued to rise recently

The EU carbon market is the oldest and most mature carbon market in the world, with the highest carbon price in the world. On August 30, the futures price of the EU carbon market exceeded 60 euros/ton, reaching the highest point since its establishment in 2005, and the carbon price continued to rise after entering September. Compared with the beginning of this year, the EU carbon price has risen by nearly 80%.

Source: ICE

There are several reasons for the high carbon price in Europe:

✔ Market Stability Reserve Mechanism (MSR)

The mechanism works by transferring 24% of the total amount of excess quotas from the previous year to the MSR and reducing the number of these quotas in the next year's auction. As a result, the total amount of actual auctioned allowances in the EU ETS in 2021 has been reduced by 40%, making the supply of allowances scarce, resulting in an increase in carbon prices.

✔ Efforts to reduce emissions have been stepped up

On July 14, the European Union proposed a package to combat climate change, aiming to reduce the EU's net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. The introduction of the plan increases the demand for carbon allowances and further stimulates market investment confidence, thereby driving up the carbon price.

✔ Gas prices are growing

Recently, the price of natural gas in Europe has risen dramatically, reaching a record high. The increase in natural gas prices has given coal a cost advantage, and power generation companies have expanded their thermal power production, which has boosted the demand for carbon allowances.

There are a variety of factors that affect the price of carbon

Including policy system, macroeconomics, energy prices, etc

What experience can China learn from to increase carbon prices?

✔ Control the total number of quotas and adjust the quota allocation mechanism

At present, there is an oversupply of allowances in China's carbon market, and enterprises lack the motivation to buy allowances, resulting in low market activity. The appropriate introduction of the EU carbon market's quota control mechanism, reducing the total amount of allowances to a reasonable level, and gradually increasing the proportion of initial allowance paid allocation, can improve the activity of the carbon allowance market.

✔ Refine emission reduction targets and strengthen awareness of emission reduction

Under the guidance of the goal of "carbon peak by 2030 and carbon neutrality by 2060", the corresponding emission reduction targets should be further refined to the enterprise level, so that individual enterprises can realize the arduousness and urgency of the emission reduction task, so as to stimulate their independent emission reduction motivation.

✔ Introduce diversified investment entities

The formation of carbon price requires market liquidity and market activity as a guarantee, and the introduction of diversified investment entities is conducive to better stabilizing carbon prices and diversifying the risks brought about by changes in the investment environment. China's carbon market can gradually expand the scope of trading entities, increase product categories, and encourage more social capital investment.

On September 7, 2021, the national green power trading pilot was officially launched, with 7.935 billion kWh of electricity traded for the first time, and it is expected to reduce carbon dioxide emissions by 6.0718 million tons.

Through green electricity trading, companies can reduce carbon emissions from traditional electricity consumption methods by directly purchasing 100% clean energy electricity, which provides a new channel for enterprises to achieve carbon neutrality. As another innovative market-based trading mechanism that also promotes emission reduction, green electricity trading will inevitably have an impact on the national carbon market.

At present, the transaction cost of green electricity is 50~80 yuan/ton, which is still higher than the price of 40~50 yuan/ton in the national carbon market. In the future, the coordination and convergence of the national carbon market and the green electricity trading mechanism will become a new opportunity and challenge for China to explore and practice the path of carbon neutrality.

Next article:Xi Jinping talks about the energy industry: take the path of green and low-carbon development

0 comments

Related testimonials

CCTV Finance × Sany Heavy Industry: Transportation construction continues to heat up! In May, the infrastructure was full of bright spots →

2025.06.17

CCTV Finance × Sany Heavy Industry: Infrastructure results are released! Anhui is soaring, and the equipment of the western port has become a "dark horse"

2025.05.19

China's installed wind and solar capacity has historically surpassed that of thermal power

2025.04.28

0 comments