When will the wind power industry enter a period of recession?

2024.04.15

Wind power world

If you count from the 70s of the last century, when the first wind turbine that can generate electricity appeared, China's wind power industry has gone through more than 50 years of history, and the time is not short. But the impression to the outside world is that wind power still seems to be a sunrise industry, in a thriving stage.

So, what stage of development is wind power in? When will it move on to the next phase? For friends who are engaged in market research and investment, it is a topic that must be clarified; It also means a lot to every practitioner, after all, it is about our jobs.

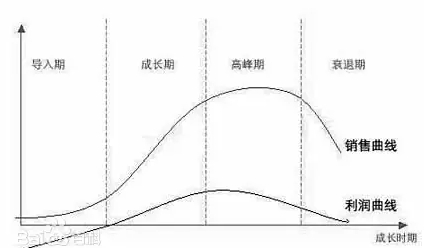

There is a special theory for studying the development process of the industry, called the "industry life cycle". Broadly speaking, it divides the development of an industry into four stages, that is, the naïve period (introduction period), the growth period, the maturity period (peak period), and the decline period.

In the infancy period (introduction period), the product design is not yet mature, the industry profit margin is low, the market growth rate is high, the demand growth is fast, the technology changes are large and there is great uncertainty, and the entry barriers of enterprises are low.

The infancy period (introduction period) of China's wind power industry was probably before 2009. At that time, China's wind turbine design was in the early stage of independent research and development, and all kinds of technical route units had room for survival. There are a large number of wind turbine manufacturers participating in the market, which once reached more than 80. The profit margin of the industry is very low, and the equipment research and development funds mainly rely on national or local support. There is uncertainty in project development due to the instability of electricity price policies such as concession bidding. At this stage, the "Notice on Improving the Feed-in Tariff for Wind Power Generation" finally ended with the four types of regional fixed electricity prices, after which wind power entered an accelerated growth track.

In the growth period, the growth rate of the market will be very high, the demand will grow rapidly, the technology will gradually become finalized, the entry barriers of enterprises will increase, and the product variety will increase.

The growth period of China's wind power industry is probably between 2010 and 2022. From the perspective of market growth rate, wind power grew rapidly during this period, but by 2021, after the wind power was rushed, the market growth rate had nothing to do with "very high". In 2022, the technology of the whole machine will be basically finalized as mainly doubly-fed on land and medium-speed permanent magnet on sea. Whether it is to enter the whole machine, or the threshold of the parts market has been significantly improved. In particular, machine manufacturers have begun to develop their own key components, which has raised the technical and financial threshold of the whole machine and even parts. The iteration speed of wind turbine products has been significantly accelerated, and the life cycle of a model has dropped from about 3 years in 2010 to less than 1 year.

In the mature period (peak period), the growth rate of market demand is not high, the technology is mature, the buyer's market is formed, the profitability of the industry declines, the development of new products and new uses of products is more difficult, and the barriers to entry in the industry are high.

The maturity (peak) period of China's wind power industry is probably from 2023 to 2050. During this period, wind power will still achieve a certain growth rate driven by the 3060 policy and energy substitution demand, but the trend has slowed down. In at least five years, China's new wind power capacity will remain at about 70 million kilowatts to 100 million kilowatts; Before entering a recession, it could reach up to 200 million kilowatts. The market demand of such a scale needs to be realized by activating the deep-sea, decentralized, Qinghai-Tibet Plateau, overseas markets, direct supply from large users, and stock markets. Among them, only the direct supply of large users and the stock market have the highest certainty. Other markets require greater collaboration among departments to solve challenges. After 2023, with the increase of resource fees, not only wind turbines and parts, but also the profitability of wind power development will begin to decline. The development of new complete products and application scenarios will become more and more difficult, and the most notable feature is that the magnitude of wind power technology progress has not been as good as before.

The author regards 2050 as the node when China's wind power enters a period of decline, mainly based on three judgments.

First, at the current pace of development, China can basically complete the 2030 new installed capacity target of wind and solar power to support carbon peak in 2024, and the new installed capacity target to support carbon neutrality can be completed before 2040. After that, there will be some uncertainty about the direction of the policy. By 2050, policy-level support will basically weaken to a negligible level, and the market will be the only dominant factor.

Second, although China's wind resources are currently less than 2% developed, land (sea) resources are limited. As the land (sea) resources available for wind power development are becoming less and less, China will basically complete the development stage of large-scale new installed capacity by 2030. Based on the 20-year update of the unit's operation, by 2050, all the new units before 2030 will complete 1-2 rounds of replacement, and the installed capacity dividend brought by the new market will no longer exist, and will be supported by the stock.

Third, based on the current increase of 1-2 percentage points in the proportion of wind power in China's electricity per year, by 2040, the proportion of wind power + photovoltaic will most likely exceed 60%, the energy revolution is completed, and the new wind power will need more energy storage or peak shaving measures to support, and the development cost will surge, and the new demand will be inclined to peak shaving power supply rather than new energy.

Related testimonials

CCTV Finance × Sany Heavy Industry: Transportation construction continues to heat up! In May, the infrastructure was full of bright spots →

2025.06.17

CCTV Finance × Sany Heavy Industry: Infrastructure results are released! Anhui is soaring, and the equipment of the western port has become a "dark horse"

2025.05.19

China's installed wind and solar capacity has historically surpassed that of thermal power

2025.04.28

0 comments