Wind power development "the country advances and the people retreat", there is no need to be entangled

2024.09.13

Wind power world

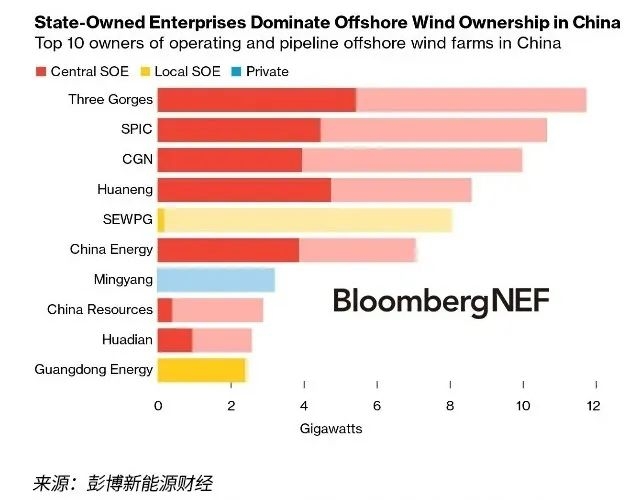

Recently, Bloomberg New Energy Finance released an analysis of the cumulative installed capacity data and ranking of offshore wind power developers in China, mentioning that the market share of owners under the jurisdiction of central or local governments has reached 97%, while private and foreign companies account for only 3%. In this ranking released by Bloomberg New Energy Finance, only the dark part is the installed capacity, and the light part is the project reserve. According to this list, China's cumulative installed capacity + reserves of offshore wind power are ranked from top to bottom: Three Gorges, State Power Investment, China General Nuclear Power Corporation, Huaneng, Electric Wind Power, State Energy Investment, Mingyang Intelligence, China Resources, Huadian, and Guangdong Energy. Although Electric Wind Power and Mingyang Intelligent are in the middle of the list, they have very little installed capacity as developers.

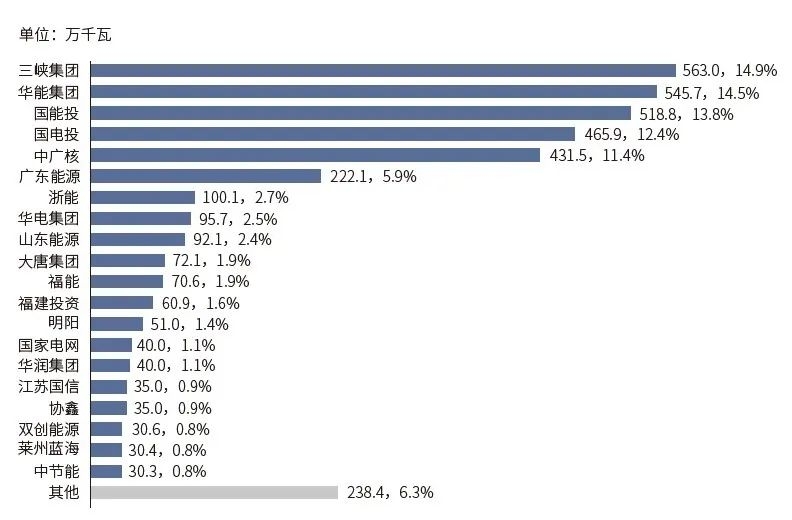

If the above list is based only on cumulative installed capacity, then as of June 2024, the ranking order of China's offshore wind power developers should be: Three Gorges, Huaneng, State Power Investment, China General Nuclear Power Corporation, State Energy Investment, Guangdong Energy, Huadian China Resources, Electric Wind Power, and Mingyang Intelligence. This is a problem, the cumulative installed capacity of the list is clearly inconsistent with the cumulative installed capacity ranking of offshore wind developers published by CWEA.

According to CWEA data, the cumulative installed capacity of offshore wind power in 2023 has reached 5,188MW, ranking third. According to data from Bloomberg New Energy Finance, the company's cumulative installed capacity of offshore wind power will be less than 4,000MW by June 2024, ranking fifth. The same situation also happened to State Power Investment Corporation, China General Nuclear Power Corporation, etc. This suggests that there may be significant differences in the statistical caliber of the two institutions.

Aside from the data discrepancies, in fact, from the perspective of conclusions, Bloomberg New Energy Finance is undoubtedly correct. At present, China's offshore wind power development is definitely based on "central enterprises, supplemented by state-owned enterprises, and supplemented by private enterprises". According to the data released by CWEA on the top 10 cumulative installed capacity of offshore wind power developers in 2023, the top five, as well as the eighth and tenth are all central enterprises, with a share of 71.4%; the sixth, seventh and ninth are state-owned enterprises, with a share of 11%; The top private company is Mingyang, which is no longer in the top 10, ranking 13th, with a share of only 1.4%, which is less than one-tenth of the first Three Gorges.

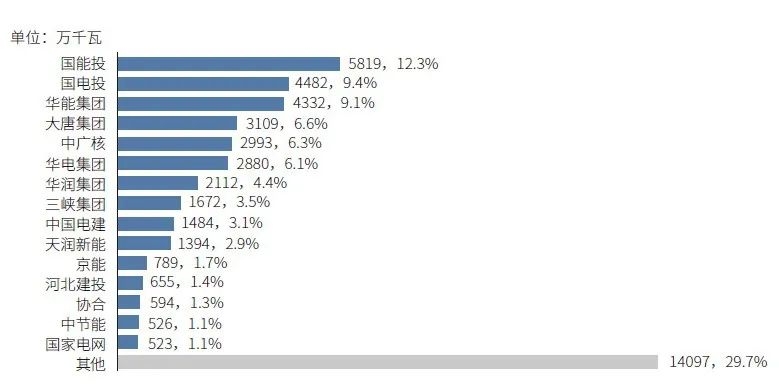

In fact, the fact that offshore wind power development is dominated by state-owned enterprises is not worth mentioning. Because from the perspective of the overall cumulative installed capacity (onshore + offshore) of China's wind power developers, this trend is more obvious than that of offshore wind power.

According to data, in 2023, the top nine wind power developers in China in terms of cumulative installed capacity are all central enterprises, and only Tianrun New Energy, which ranks tenth, is a private enterprise and a subsidiary of Goldwind Technology. Since the eleventh place, I have gradually seen the shadow of other state-owned enterprises and private enterprises.

Therefore, offshore wind power development is actually relatively more suitable for private enterprises. Onshore wind power, especially in recent years, has been largely acquired by central state-owned enterprises, and it is even more difficult to get new projects. So, what causes the "national advance and national retreat" of wind power in project development?

First, the strength of central enterprises is extremely strong. The strength of central enterprises is reflected in all aspects, including the cooperative relationship with the government, including lower financing costs, as well as stronger capital reserve capacity, stronger large-scale project construction, development, operation and management capabilities, and stronger equipment and engineering price reduction capabilities (almost all ultra-low-cost centralized procurement projects are created by central state-owned enterprises), etc., which can help central enterprises achieve higher project investment returns.

Second, the development concept is different. The revelation of the outbreak of the Russia-Ukraine conflict to European countries is that energy security is an issue that a country should pay the most attention to and must solve, and it is unreliable to hand it over to capital. The demand for energy security, coupled with the political task of achieving the dual carbon goals, has made central enterprises the backbone of continuously improving the scale of wind power development.

Third, state-owned enterprises are irreplaceable. Behind local SOEs are local governments. With the sharp decline in real estate in recent years, local finances have begun to tighten, and areas with wind resources have found a new "way to finance", that is, taxes related to wind power development and income from electricity sales. The financial needs and development needs are in perfect harmony, the local government finances have been replenished, and the scale of state-owned enterprises has been developed.

Therefore, whether it is offshore wind power or onshore wind power development, the trend of central state-owned enterprises will not change in the short term. Even in Europe, such as the United Kingdom, the new Labour government has decided to create a new national energy system operator.

In his recent speech, the King of the United Kingdom mentioned that in the "current institutional and policy environment", it is "highly unlikely" that the private sector alone will achieve the scale and pace of investment needed to decarbonise the electricity system. This is to be achieved through the establishment of a national clean energy company (GB Energy) to work with the private sector on clean energy investments and to promote, encourage and participate in the production, distribution, storage and supply of clean energy. The company will "help mitigate existing market allocation failures" and "increase the speed and cost of deploying renewable energy generation."

Related testimonials

CCTV Finance × Sany Heavy Industry: Infrastructure results are released! Anhui is soaring, and the equipment of the western port has become a "dark horse"

2025.05.19

China's installed wind and solar capacity has historically surpassed that of thermal power

2025.04.28

Breakthroughs have been made in the challenges of customization and high precision, and new progress has been made in the intelligent production of high-end equipment

2025.03.24

0 comments