Sany Heavy Industry Sany Heavy Industry Co., Ltd. (SH:600031)

Trinity International Sany International (HK:00631)

Sany Renewable Energy Sany Renewable Energy (SH:688349)

Home > Media coverage > Revenues have increased dramatically! Japanese media focus on Sany overseas business!

Revenues have increased dramatically! Japanese media focus on Sany overseas business!

2023.07.04

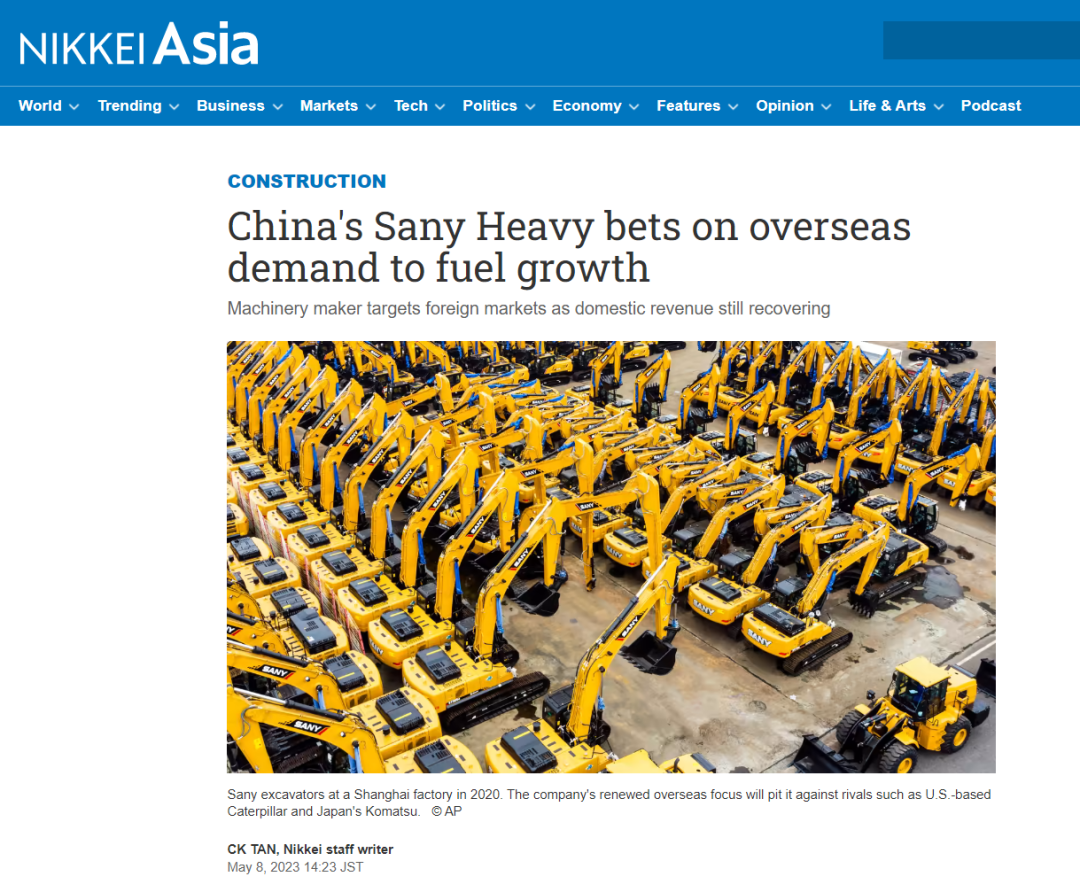

Nikkei Asia

Recently, the Japanese media "Nikkei Asia" published an article "China's Sany Heavy bets on overseas demand to fuel growth" (Sany Heavy Industry hopes that overseas demand will boost growth), focusing on the pace of promoting Sany's internationalization strategy.

The following is an excerpt from Nikkei Asia:

Buoyed by record overseas revenues last year, China's largest construction machinery maker by market capitalization has decided to increase its investment in foreign markets.

Sany has made it clear that the company will focus on developed economies to enhance localization through a strategy of localized hiring and more investment in high-tech manufacturing. According to Counterpoint Research, the Hunan-based group ranked third in global construction machinery shipments in 2022, with a market share of 8.4%. Last year, Sany's international business revenue surged by 47%.

Sany emphasized that the benefits this time come from making "digitalization, localization and service" a top priority. Sales grew by double digits across all five continents, with North America seeing the fastest growth of 85 percent, followed by South America at 63 percent, Europe at 44 percent, Asia Pacific at 41 percent and Africa at 35 percent.

Ni Tao, editor-in-chief of Cnrobopedia.com, a Shanghai-based market intelligence provider, said: "Another obvious advantage of adopting an internationalization strategy is that it can spread the risks posed by the domestic economic downturn and fierce domestic competition.

Faced with the recovery from the pandemic still uncertain, Sany expects revenue growth of 10% in 2023, pinning its hopes on further growth in overseas business. Sany said that as the company invests more resources overseas, the mainstream markets in Europe and the United States will become the company's growth driver.

"We will accelerate the layout of the global industrial chain, increase financing support, and pay special attention to developed countries." Trinity further added. The push comes at a time when the company is planning a secondary listing in Frankfurt, Germany, where the group has its largest overseas manufacturing and R&D center.

According to the China Construction Machinery Industry Association, China's excavator exports reached 109,457 units in 2022, a year-on-year increase of 60%.

Guotai Junan Securities said in the report that "the main beneficiaries of Chinese manufacturers are the stimulus measures introduced by the United States and other developed countries to recover from the pandemic." It added that China's cost-effective products are one of the factors and expects overseas sales to drive the future performance of Chinese manufacturers.

Sany is demonstrating its high-tech ambitions. Last year, the company opened a "lighthouse factory" in Indonesia.

The 100,000-square-meter facility, located on the outskirts of Jakarta, has invested $30 million to improve the productivity of the supply chain using digital tools.

The plant will assemble excavators ranging from 13 to 55 tons for the Southeast Asian market, with an initial annual production capacity of 3,000 units. Compared to the 30 days of a traditional factory, the production cycle of this plant only takes 7 days.

Sany plans to build 10 such factories around the world, and 25 such plants are already in operation in China.

Soumen Mandal, senior analyst at Counterpoint, said, "Industry trends towards electrification and automation will be key drivers of revenue growth. ”

Rail-mounted container gantry crane automation

Rail-mounted container gantry craneRecommended products

automation

Rail-mounted container gantry crane automationRelated testimonials

Special attention to the two sessions! CCTV's "Economic Half Hour" focuses on Sany's "chain breakthrough"

2025.03.10

Hunan businessmen on the ASEAN Silk Road丨Hunan heavy weapons shine in the "country of ten thousand islands"

2024.09.29

Hunan Satellite TV's "Noon News": Sany Energy helped Zhuzhou's exports to the province's growth rate first

2024.06.12

0 comments