Steady and far-reaching, quality wins the world, Sany International's 2024 annual results are announced

2025.04.02

Sany Group

On April 1, Sany International's 2024 annual results briefing was held in Changsha Sany Industrial City, attended by 13 company management including Xiang Wenbo, director of Sany International and chairman of Sany Group, and about 70 investor representatives.

In 2024, in the face of the dual pressures of the downward cycle of China's coal equipment industry and the intensification of global geopolitical competition, the company's mining equipment segment still maintained strong performance resilience, and the logistics equipment business continued to grow rapidly, jointly consolidating the performance foundation of Sany International. Sany International achieved operating income of 21.9 billion yuan, a year-on-year increase of 8%; The net profit attributable to the parent company was RMB1.10 billion, a year-on-year decrease of 43%, mainly due to the impairment of goodwill and the impairment of properties for sale. After excluding the above impact, the net profit attributable to the parent company was about 1.85 billion yuan, a year-on-year decrease of 4%.

In terms of operation, Sany International adheres to long-termism and continues to deepen its global layout, digital and intelligent transformation, and R&D and innovation. The performance of overseas markets is particularly bright, and has become an important growth engine for the company. In 2024, Sany International will achieve overseas sales revenue of 8.2 billion yuan, a year-on-year increase of 28% and a five-year compound growth rate of 57%.

In terms of management, the company adheres to the policy of high-quality development and management, and has made significant improvements in cost control, inventory control, and human efficiency control by focusing on its main business, intensive resources, refined control, and total amount control.

After reporting the agenda, Xiang Wenbo expressed his affirmation of Sany International's business performance in 2024 and made an important outlook on the business prospects in 2025. Subsequently, Xiang Wenbo and the management team of Sany International gave detailed and detailed answers to the issues of high concern to investors, the business progress that needs to be understood urgently, and the relevant resolutions of the company's board of directors, and clearly expressed their confidence in achieving the company's business goals for 2025-2027.

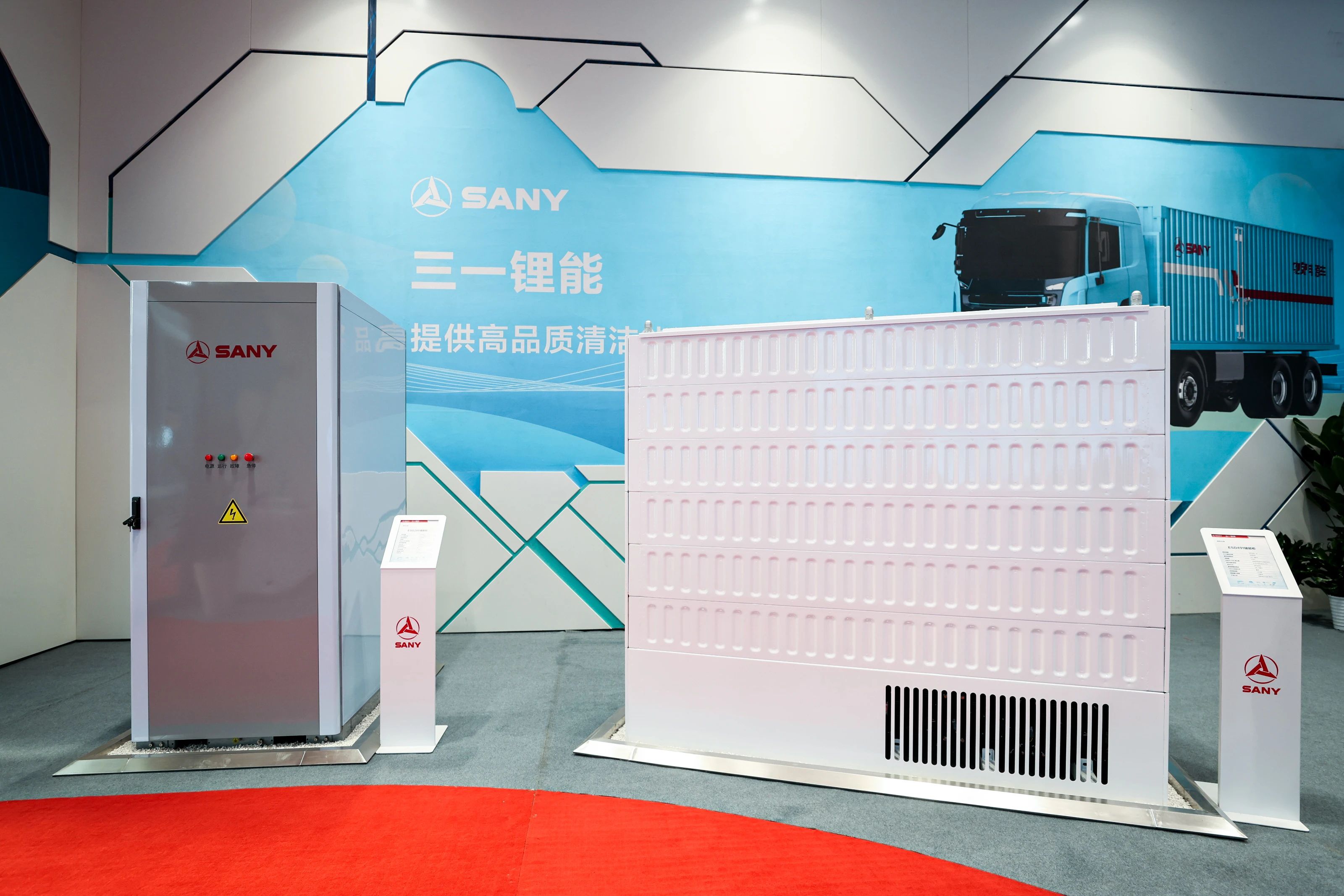

Sany International adheres to the development theme of "steady and far-reaching, quality wins the world", and achieves continuous growth in performance while operating steadily. In the future, the company will actively develop new energy industries based on lithium energy, hydrogen energy and silicon energy, and cultivate the second growth curve of Sany International.

On the day of the results announcement, Sany International's closing stock price was HK$5.23 per share, up 9.87% during the day.

0 comments