In the next 15 years, oil will continue to maintain its status as the main energy source

2023.05.23

China Petroleum News Network

In the 2023 edition of the bp World Energy Outlook, bp provides a comprehensive assessment of the impact of geopolitical conflicts and the US Inflation Reduction Act on the global energy sector, and explores the megatrends and uncertainties that predict the world's energy transition by 2050. Global carbon emissions are expected to peak in the 20s of the 21st century, and by around 2050, global carbon emissions will be about 30% lower than in 2019. It is expected that in 2030, global oil demand may reach a peak, and in the next 15~20 years, oil will still maintain a dominant position in the global energy system. By 2050, renewables will account for 65% of global primary energy consumption.

Geopolitics has a profound impact on the development of the global energy system

The impact of geopolitical conflicts and the passage of the Inflation Reduction Act in the United States has had a profound impact on the energy sector.In the short term, the disruption and shortage of global energy supply caused by geopolitical conflicts has indirectly stimulated many EU countries to switch from imported fossil fuels to locally produced non-fossil fuels.In the long term, global GDP is expected to grow at an average annual rate of about 2.4%, and many governments have stepped up their support for the energy transition, such as the United States, which passed the Inflation Reduction Act. To meet the challenge of decarbonization, the energy sector needs more support from governments, including speeding up the approval of low-carbon energy and infrastructure construction projects.

There are four major trends in the evolution of global energy demand

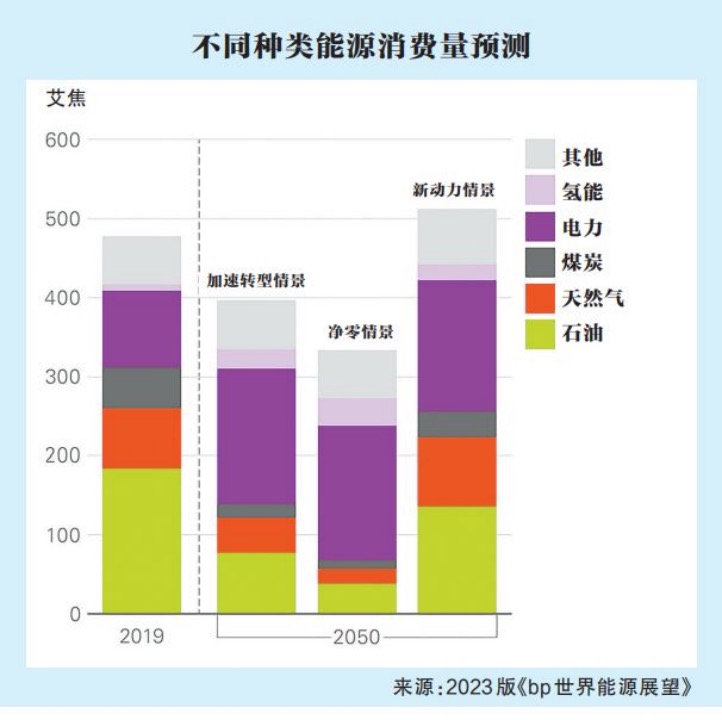

There are four main trends in the global energy demand: the declining status of oil and gas, the rapid growth of renewable energy consumption, the spread of electrification, and the large-scale application of low-carbon hydrogen.bp's World Energy Outlook revolves around three energy transition scenarios: net-zero scenarios, accelerated transition scenarios and new power scenarios. The net-zero scenario and the accelerated transition scenario assume a significant tightening of global climate policy. Under the net-zero scenario, global carbon emissions will be reduced by about 95% by 2050 compared to 2019 levels. Under the accelerated transition scenario, global carbon emissions will be reduced by about 75% by 2050. Shifts in societal attitudes and consumer behaviour will further improve energy efficiency and increase the use of low-carbon energy. The new power scenario is designed to reflect the overall trajectory of the current global energy system and take into account the decarbonization policies and commitments of governments in recent years.

Total global final energy consumption is likely to peak within 10 years

Under the accelerated transition scenario and the net-zero scenario, the total global final energy consumption will peak in the next 5~10 years, and the total global energy consumption is expected to decrease by 15%~30% in 2050 compared with 2019. However, under the new power scenario, global final energy consumption will still rise around 2040 and then remain broadly stable, with total global energy consumption in 2050 10% higher than in 2019, mainly due to energy efficiency.

In the three scenarios, it is expected that by 2050, the proportion of fossil fuels in global final energy consumption will drop from about 65% in 2019 to 20%~50%. Electricity use will increase significantly, and by 2050, electricity consumption will increase by 75%, and the proportion of global final energy consumption will increase from 25% in 2019 to 33%~50%. With the growth of renewable energy cost competitiveness and the introduction of more and more low-carbon energy development support policies, it is expected that by 2050, the proportion of renewable energy in global primary energy consumption will increase from about 10% in 2019 to 35%~65%. By 2050, low-carbon hydrogen is expected to account for 13%~21% of global primary energy consumption.

Global oil demand is likely to hit a plateau in the next 10 years

Improvements in energy efficiency in the transport sector and the gradual spread of alternative energy sources will reduce some of the oil demand, and it is expected that global oil demand may enter a plateau and then decline in the next 10 years. However, in the next 15~20 years, oil will continue to dominate the global energy system.Under the accelerated transition scenario and the net-zero scenario, oil will maintain its position as the world's main energy source until 2035, with an estimated global consumption of 70 million ~ 80 million barrels per day. Subsequently, global oil consumption will decline, to 40 million b/d by 2050 under an accelerated transition scenario and 20 million b/d under a net-zero scenario. Under the new power scenario, global oil consumption could be closer to 100 million b/d by 2030 and then gradually decline to about 75 million b/d by 2050.

The demand for low-carbon hydrogen will increase tenfold

The use of hydrogen energy is expected to continue to increase globally. Low-carbon hydrogen will play a key role in the decarbonization of the energy system, especially in sectors such as industry and transportation. The use of modern biomass energy, such as solid biomass fuels, biomethane, and biofuels, will grow rapidly, helping to support the decarbonization of industries and industrial production that are difficult to reduce carbon emissions.

It is estimated that in 2030~2050, the global demand for low-carbon hydrogen will increase by 10 times, reaching nearly 300 million tons/year and 460 million tons/year under the accelerated transition scenario and net zero scenario, respectively. It is estimated that by 2050, low-carbon hydrogen energy will account for 5%~10% of the global industrial terminal energy demand, of which the demand for low-carbon hydrogen in the steel industry will account for about 40% of the industrial hydrogen demand. By 2050, low-carbon hydrogen and hydrogen-derived fuels are expected to account for 10%~20% of the final energy demand of the transportation industry. Green hydrogen will account for 60% of low-carbon hydrogen supply by 2030 and 65% by 2050, with the majority of the remainder coming from blue hydrogen, and a small portion from biomass hydrogen production using BECCS (Biomass-Carbon Capture and Storage).CCUS (carbon capture, utilization, and storage) will play a key role in the low-carbon energy transition, and industrial carbon capture will help address fossil fuel carbon emissions by decarbonizing it at source. Under the accelerated transition scenario and net-zero scenario, global carbon capture is expected to be 400 million ~ 600 million tons of carbon dioxide equivalent by 2050; Under the new power scenario, global carbon capture would reach 100 million tonnes of carbon dioxide equivalent. Given the long development cycle of CCUS carbon sequestration facilities and related transportation facilities, most of the world's CCUS capacity will be completed after 2030.Although governments are taking steps to combat climate change, reality shows that global carbon emissions have been increasing year on year since the 2015 Paris Climate Change Conference, with the exception of 2020. The longer there is a delay in taking decisive action to sustainably reduce greenhouse gas emissions, the greater the potential economic costs and the greater the social impact.

Wind, solar and biomass will explode

Due to cost reduction and policy support, wind and solar energy will develop rapidly in the future, becoming an important support for low-carbon power sources and green hydrogen production. Under the accelerated transition scenario and the net-zero scenario, the global installed wind and solar power capacity will increase by 450~600 GW per year by 2035, which is 1.9~2.5 times the highest growth rate in the past.Modern biomass energy, including solid biomass fuels, biofuels and biogas, will grow rapidly, helping hard-to-decarbonize industries to achieve carbon reduction. Under the accelerated transition scenario and the net-zero scenario, the global supply of modern biomass energy will double to 65 exajoules by 2050; Under the new power scenario, it is slightly lower, at nearly 50 exajoules.

Under the accelerated transition scenario, about 5 exajoules of biomass energy will be used for BECCS (Biomass-Carbon Capture and Storage) projects by 2050. Under the net-zero scenario, BECCS would use 13 exajoules of biomass energy, half of which would be used to generate electricity and the rest to produce hydrogen.

Under the accelerated transition scenario and the net-zero scenario, global biofuel production will reach 10 exajoules by 2050, with the majority going to aviation, with bio-based jet fuel accounting for 30% and 45% of the industry's total fuel demand, respectively.

Electric vehicles will be the absolute mainstay of new car sales

Under the accelerated transition scenario and net-zero scenario, it is expected that the global number of electric vehicles will increase to 550 million ~ 770 million by 2035 and 2 billion by 2050, accounting for 80% of the global car ownership. It is expected that in 2035, electric sedans will become the absolute main force of new car sales.

Under the new power scenario, the global number of electric vehicles and electric light trucks will grow slowly, albeit slowly, but still reach about 500 million units, and electric cars will account for about 40% of new car sales, and about 70% in 2050. China, Europe, and North America will be the main regions for global EV sales growth. By 2035, the total sales of electric vehicles in China, Europe and North America will account for 60%~75% of the world's new electric vehicle sales, and by 2050, the proportion will be 50%~60%.

Medium-duty trucks, heavy-duty trucks and buses, which still rely on diesel, will also be electrified and switched to hydrogen. Under the accelerated transition scenario and net-zero scenario, the global diesel truck share will decline from about 90% in 2021 to 70%~75% by 2035 and 5%~20% by 2050.

The sustainability of liquid fuels is unstoppable

Petroleum-based jet fuel is expected to remain dominant between now and 2030, with the use of sustainable aviation fuel (SAF) increasing, and the share of petroleum-based jet fuel in biojet fuel demand will decline to 60% by 2050 under the accelerated transition scenario and the net-zero scenario, respectively. By 2050, biojet fuel and hydrogen-derived fuels will be the main sustainable aviation fuel (SAF).Hydrogen-derived fuels, including ammonia, methanol and synthetic diesel, will be the main alternative to petroleum-based marine fuels. Under the accelerated transition scenario and the net-zero scenario, hydrogen-derived fuels will be promoted on a large scale after 2035, and by 2050, the proportion of total global marine fuel demand is expected to be 30%~55%; Under the new power scenario, petroleum-based marine fuels still account for more than 75% of the total global marine fuel demand.

In this context, Sany Petroleum is committed to providing efficient and flexible integrated solutions for energy development and utilization by combining its years of equipment research and development advantages, so as to create maximum value for customers.

Recommended products

Related testimonials

Start with the Red Sea! Wind power retirement market pains

2025.06.25

CCTV Finance × Sany Heavy Industry: Transportation construction continues to heat up! In May, the infrastructure was full of bright spots →

2025.06.17

CCTV Finance × Sany Heavy Industry: Infrastructure results are released! Anhui is soaring, and the equipment of the western port has become a "dark horse"

2025.05.19

0 comments