Sany International acquired Sany Petroleum Technology and entered the oil and gas equipment industry

2023.04.14

Sany Group

After trading on April 12, Sany International (00631. HK) announced that the company has signed an acquisition agreement with the seller Sany Perpetual Enterprise Holdings Company Limited to purchase its entire equity interest in Sany Petroleum Technology Hong Kong Limited (hereinafter referred to as "Sany Petroleum Technology"), which is valued at RMB 4.281 billion.

It is worth noting that after considering the valuation, the final price of this transaction was determined to be 2.98 billion yuan, and the company acquired petroleum equipment assets at a discount, reflecting the support of major shareholders for Sany International. Since Sany International announced the acquisition, the stock price performance has shown the recognition of the acquisition by the capital market.

According to the announcement, Sany Petroleum Technology was established in 2015 as a holding company, and its main business is operated by its Sany Petroleum Intelligent Equipment and its subsidiaries. It is mainly engaged in oil and gas field fracturing and cementing stimulation related equipment and technical services, and is committed to ensuring national energy security and providing customers with safe, efficient, intelligent and environmentally friendly complete sets of petroleum equipment and comprehensive solutions and integrated services. This acquisition marks Sany International's expansion of its energy equipment business and its official entry into the oil and gas equipment industry.

According to the financial information disclosed in the announcement, the total assets of Sany Petroleum Technology are about 2.301 billion yuan, with a revenue of 2.087 billion yuan, a net profit of 386 million yuan, and a gross profit margin of 35.5% in 2022. Upon completion of the acquisition, Sany Petroleum Technology will become a wholly-owned subsidiary of Sany International, and its financial results will be consolidated into Sany International's financial statements.

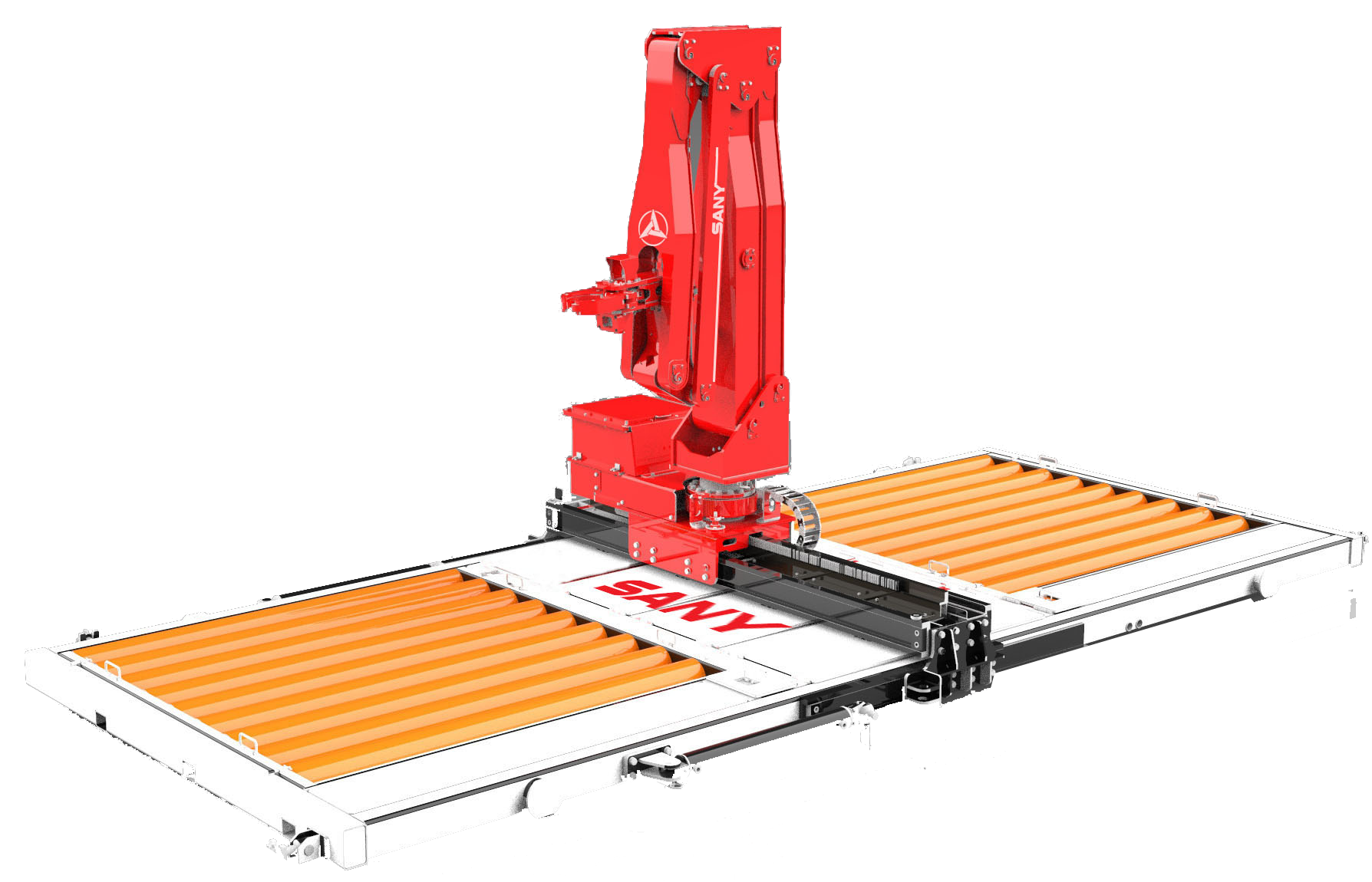

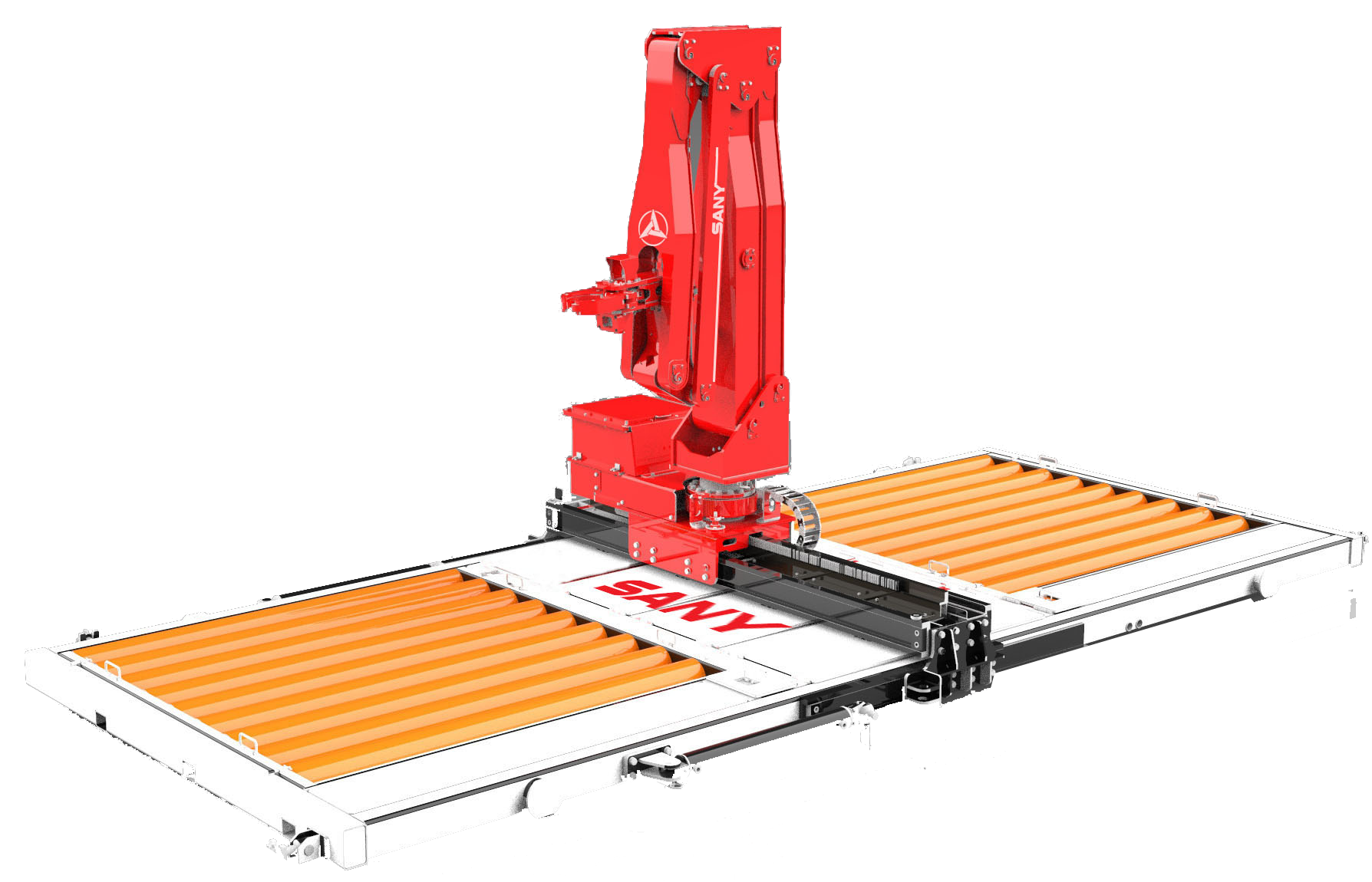

According to the announcement, Sany Petroleum Technology has a full range of complete sets of fracturing equipment products (mechanical, hydraulic, electric drive) and industry-leading drilling and workover rig string automation equipment products, and has mastered relevant core technologies, and a number of products lead the Chinese market. In 2021 and 2022, the target group's vehicle-mounted fracturing equipment maintained the first place in the industry in terms of sales volume and market share for two consecutive years.Drill table manipulator, power hydraulic station and other drilling and workover rig string automation equipment sales are also at the industry-leading level.

In addition, Sany Petroleum Technology actively grasps the trend of electrification and intelligence in the industry, and continues to deepen cutting-edge technologies such as high efficiency and energy saving, automation, unmanned and intelligent oil and gas field integration, and has now become a leader in the industry in electrification and intelligence.

For the future development strategy, Sany International said that Sany Petroleum Technology will carry out a diversified new product layout and international layout in terms of all-electric drive complete sets of equipment, pipeline engineering equipment, drilling and workover and drilling automation equipment, etc., focusing on breaking through state-owned customers and overseas customers. At the same time, in the future, it will deepen the four major fields of oil and gas equipment, oil and gas services, oil and gas engineering, and oil and gas investment, enhance its comprehensive competitiveness, improve its revenue scale and profitability, and strive to maintain its position as the No. 1 industry share in the market share of complete sets of fracturing equipment, and continue to expand its leading edge to become the No. 1 brand of oil and gas equipment in China.

The board of directors of the company believes that this acquisition will help the company continue to diversify its industrial layout, expand the subdivision of energy equipment business, and form synergies. It is conducive to resource integration, improving intelligent manufacturing capabilities, and improving equipment manufacturing capacity. It is conducive to the complementarity of electrification, intelligent technology and R&D capabilities, and accelerates the incubation of commercial achievements. It is conducive to jointly promoting the internationalization strategy and integrating and expanding sales channels. It is conducive to improving the Group's revenue scale and profitability.

Drill table manipulator Z series

Drill table manipulatorRecommended products

Z Series

Drill table manipulator Z seriesRelated testimonials

Bottoming and reversing, exceeding market expectations! Sany International's 2025 Q1 performance review

2025.05.31

The 2025 Bauma Exhibition in Germany is over, and Sany shows the hard power of globalization!

2025.04.14

Steady and far-reaching, quality wins the world, Sany International's 2024 annual results are announced

2025.04.02

0 comments